Commercial Due Diligence

Commercial Due Diligence

Going through an acquisition or disposal process in general can be quite perplex and challenging due to the numbers of factors to be considered for negotation points. To successfully navigate through an acquisition or disposal process, it is crucial to identify the potential risks surrounding the transaction. In order for the Board of Directors or private equity buyers to be confident of the deal potential or synergies as well as confirmation on the sustainability of cash flows, it is critical to achieve an understanding of all factors (addressable market size, growth prospects, demand drivers, forecasts, organizational structure and product portfolio etc.) and dynamics impacting and framing the business environment, in which the target or seller operates.

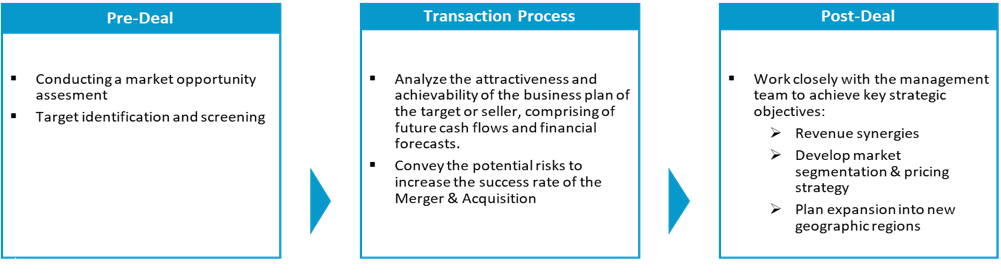

Consulta can offer our services at any stage of the transaction cycle:

Consulta is known for delivering thoughtful, robust advice in the arena of transaction services through the use of primary and secondary research combined with broad experience and state-of-the art methodologies/analysis tools.

How does Consulta’s clients benefit?

- Cut a better deal – Strengthen negotation leverage by spotting key issues

- Manage risk – Identify weaknesses ahead of time to increase the success rate of the future merger or integration process

- Boost returns – Address post-deal performance levels with a better picture of threats and opportunities in the marketplace

- Enhance credibility – Evidence backed opinions on risks and upsides to Board of Directors to fulfill their fidicuary duty of maximizing shareholder value

- Move faster – Build a deeper understanding of the business more efficiently

English

English

Turkish

Turkish