Merger and Acquisitions (Sell-Side & Buy-Side)

Merger and Acquisitions (Sell-Side & Buy-Side)

In a rapidly changing business environment, companies are actively considering range of activities in pursuit of growth. Rather than purely relying on organic growth, companies are searching for innovative business solutions to cope with slow and uncertain economy, geopolitical risks, threat of new entrants with more efficient and novel business models. Hence, CEOs turn towards various strategies, such as divestiture of underperforming divisions/assets and acquisition of business assets or capabilities, to increase the organization’s probability of success, profitability and longevity in the corresponding marketplace.

Have you ever thought expanding your business’ global reach through acquisition? Or perhaps you are a shareholder looking to liquidate your shares in the organization.

Whatever the reason might be for an acquisition or disposal, Consulta can assist you along the daunting journey to provide the right advice and guidance through each step of the transaction lifecyle, from initial planning to a success closing.

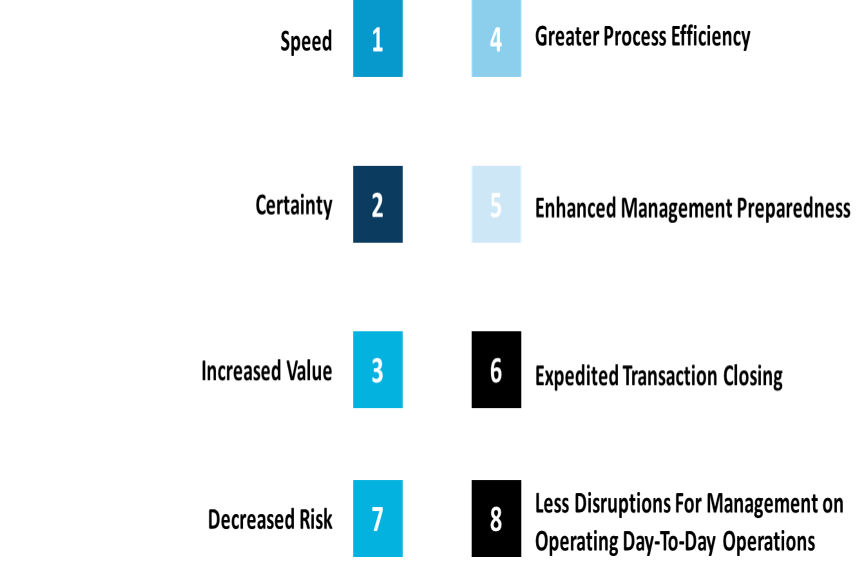

For M&A transactions, we focus on delivering the best optimum solution that focuses on four essential elements: speed, value, certainty and risk.

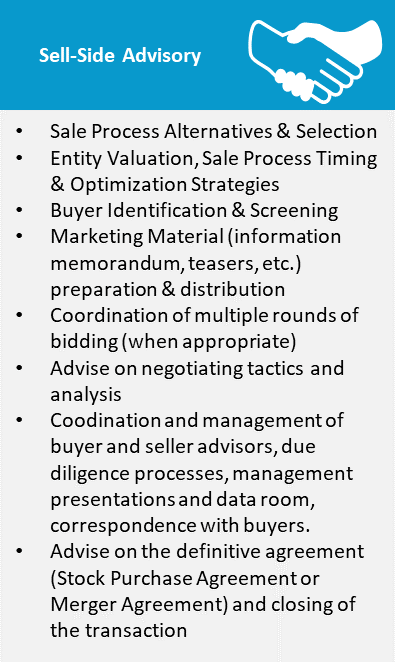

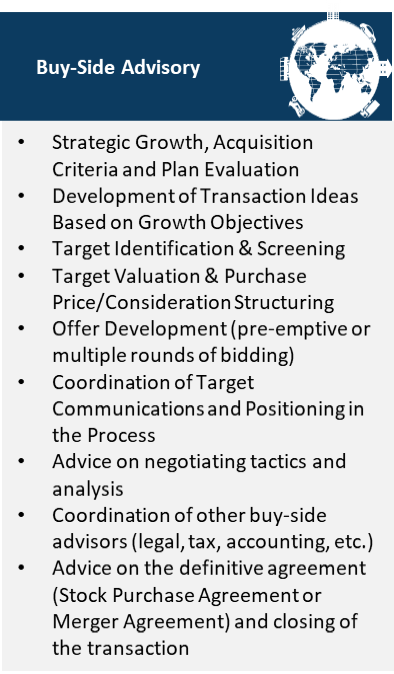

Here is how Consulta can help:

Potential benefits of retaining Consulta as an exclusive financial advisor in the context of transactions

Our knowledge spans across different M&A transactions. We can collaborate with you on sell-side, buy-side, division/subsidiary spin-offs and divestitures, cross-border deals, joint ventures and strategic alliances.

English

English

Turkish

Turkish